Brexit's Effect on New York's Ascent as a Main Monetary Center

A new review by Duff and Phelps shows that New York has surpassed London as the main worldwide monetary focus, basically because of the repercussions of Brexit. The yearly Worldwide Administrative Standpoint study included reactions from 180 chiefs across different areas, for example, resource the executives, multifaceted investments, confidential value, banking, and business.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

LATEST POSTS

- 1

Here are 10 stores where you can get a free Thanksgiving turkey

Here are 10 stores where you can get a free Thanksgiving turkey - 2

Former Peruvian President Pedro Castillo sentenced for conspiracy

Former Peruvian President Pedro Castillo sentenced for conspiracy - 3

Desired Travel Objections Worldwide: Where to Go Straightaway

Desired Travel Objections Worldwide: Where to Go Straightaway - 4

Japan deploys the military to counter a surge in bear attacks

Japan deploys the military to counter a surge in bear attacks - 5

Flourishing in Retirement: Individual Accounts of Post-Profession Satisfaction

Flourishing in Retirement: Individual Accounts of Post-Profession Satisfaction

Share this article

Vote in favor of your #1 Kind of Cap

Vote in favor of your #1 Kind of Cap Israel says soldiers wounded in Gaza fighting amid fragile truce

Israel says soldiers wounded in Gaza fighting amid fragile truce Find the Standards of Viable Refereeing: Settling Debates with Strategy

Find the Standards of Viable Refereeing: Settling Debates with Strategy Becoming Familiar with an Unknown dialect: My Language Learning Excursion

Becoming Familiar with an Unknown dialect: My Language Learning Excursion The most effective method to Perceive the Early Side effects of Cellular breakdown in the lungs

The most effective method to Perceive the Early Side effects of Cellular breakdown in the lungs ByHeart infant formula recall tied to botulism outbreak puts parents on edge

ByHeart infant formula recall tied to botulism outbreak puts parents on edge Vote in favor of Your #1 Instructive Toy: Learning and Tomfoolery Joined

Vote in favor of Your #1 Instructive Toy: Learning and Tomfoolery Joined Kidneys from Black donors are more likely to be thrown away − a bioethicist explains why

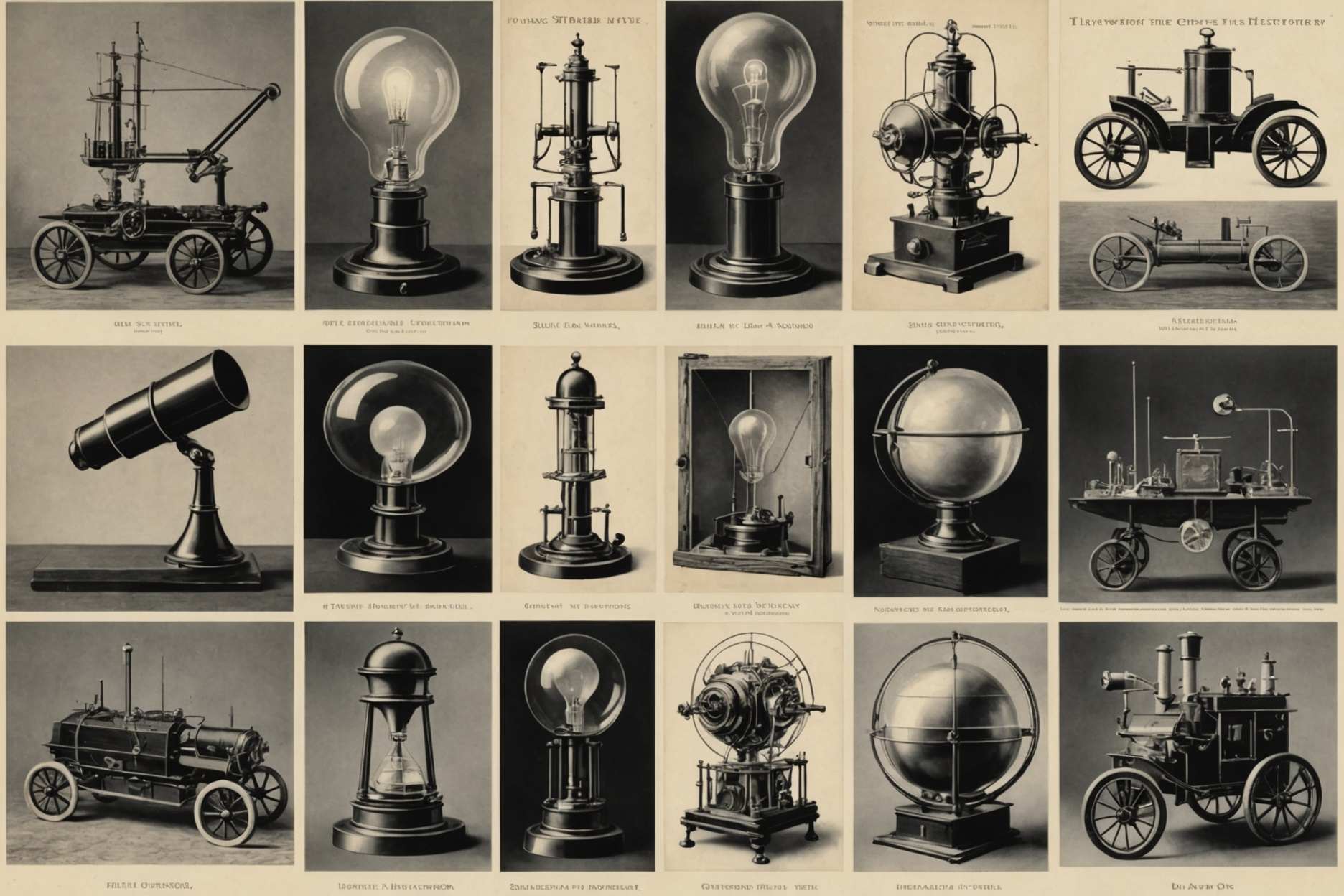

Kidneys from Black donors are more likely to be thrown away − a bioethicist explains why Eleven Creations And Developments That Steered History

Eleven Creations And Developments That Steered History